Every fortnight Kevin writes a "Kev's Column" for the Herald Express and you can read the latest edition (Published on Wednesday 9th June 2021) below:

Vaccines

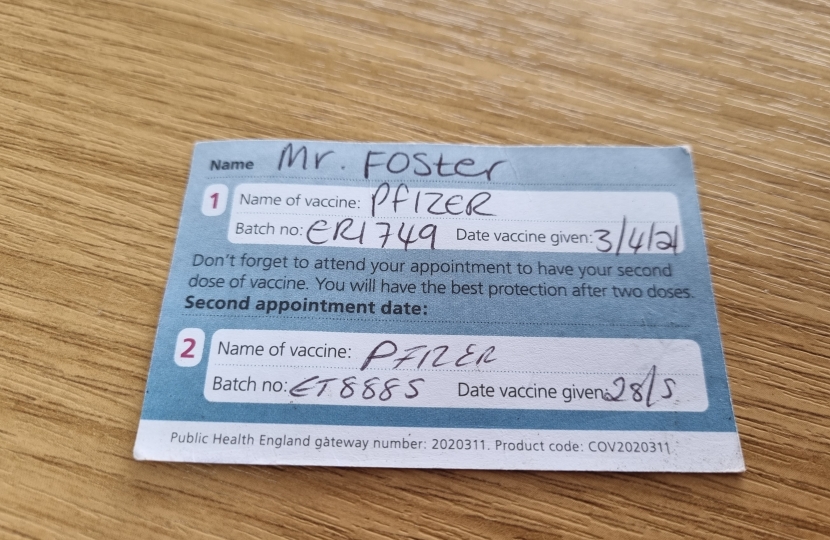

I recently headed to the Riviera Centre having been invited by my GP for a second Covid jab.

Like many other Herald Express readers, I found the process quick and efficient thanks to the staff from local GPs surgeries and the many volunteers assisting them. It was less than 10 minutes from arrival to the jab going in my arm. Since the vaccination campaign started in December the progress in our bay has been remarkable, with the under 30s starting to be invited this week for their first jabs and all adults in the bay set to be offered their first jab by the end of next month.

As we look ahead to decisions due next week about further relaxation of the current health restrictions, the increasing pace of vaccination, especially of second jabs, is a key part of this. We only need look at the numbers of tourists seen in our bay over recent weeks to note how confidence is returning amongst many who had not been away on a break for a long time.

Yet by its nature a global pandemic will only be ended by a global programme of action, hence the vital nature of discussions being held by G7 leaders this week about delivering a global vaccination programme. This will be a mammoth task, involving billions of doses across dozens of countries, but like with smallpox in decades past it is a goal we can reach, not least given the rapid progress our NHS has made with its own vaccination work.

Tax Agreement

As business has become more global and digital services can be located anywhere in the world, the issue of how to ensure large multi-nationals pay their fair share has become an ever more vital one.

It is in everyone’s interest companies can innovate and create new services, the economic changes brought by digital technology can no more be ignored than those brought by industrialisation or the railways in the past. Punitive tax rates on new tech would harm the future economy and the job opportunities it could create, but neither should traditional industries and individuals alone bear the entire burden of paying for public services, if tech giants can easily avoid doing so.

This makes the new agreement brokered at a summit of G7 Finance Ministers, hosted by the UK, so welcome. They also agreed in principle to a global minimum corporate tax rate of at least 15% to avoid countries undercutting each other and reduce opportunities for tax avoidance. The signatories include the USA, UK, France, Germany, Canada, Italy and Japan, plus the EU.

This agreement will put pressure on other nations, including Ireland, to sign up ensuring the future global economy is one which still generates the tax revenues necessary to support vital public services.

Surgery Times

I have restarted face to face advice surgeries, but telephone appointments can still be arranged if preferred. Sadly, my surgeries must remain by appointment only at this stage.

For an appointment you can either email me at [email protected] or leave a message on 01803 214989. You can also drop into my office at 5-7 East St, Torquay, TQ2 5SD between 10am & 1pm Monday to Friday, please note you may have to wait outside if others attend at the same time.