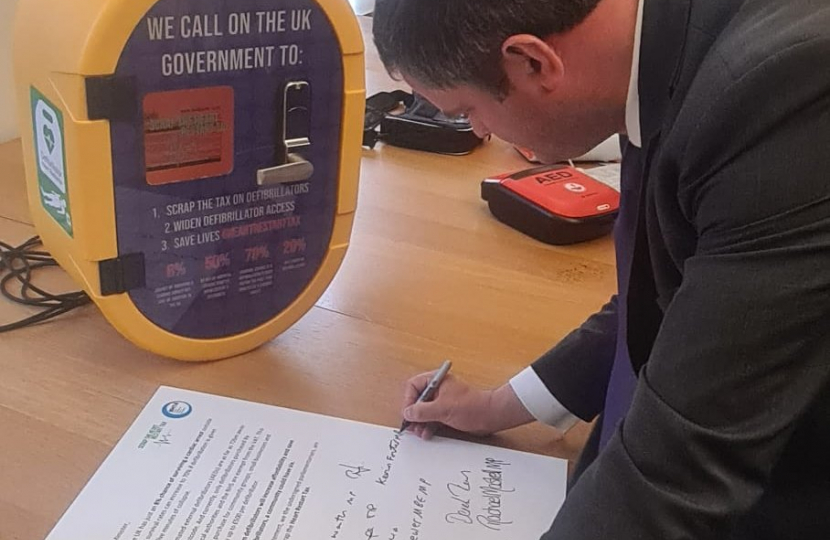

Torbay’s MP Kevin Foster has backed a campaign calling purchases of automated external defibrillators (AEDs) for businesses and community groups to be zero-rated for VAT.

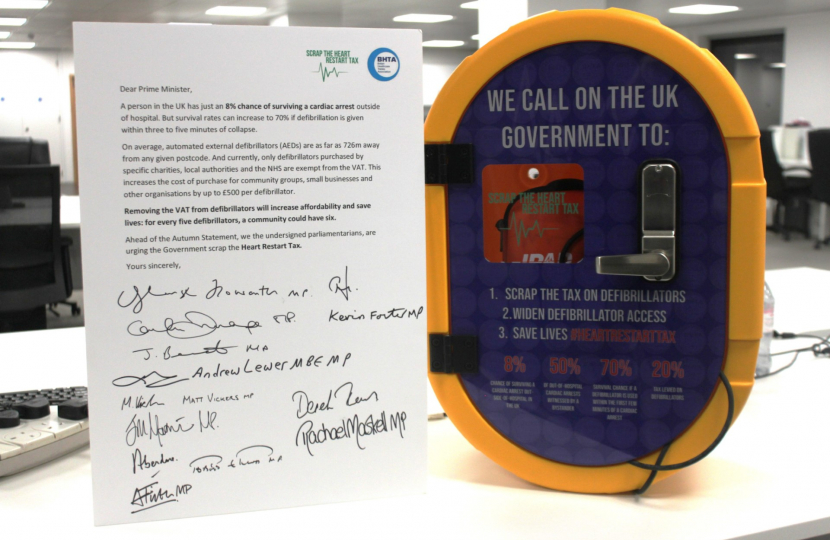

The campaign to scrap the ‘Heart Restart Tax’ has been launched by the British Healthcare Trades Association. It is calling on the Government to remove the 20% VAT currently levied on defibrillators to widen defibrillator access in public spaces and thereby save lives.

Defibrillators are used to restart a person’s heart in the event of sudden cardiac arrest and early treatment can increase survival rates to as high as 70% if defibrillation is given within three to five minutes of collapse.

Despite this, only AEDs purchased by or donated to specific charities, local authorities and the NHS are exempt from VAT – increasing the cost of purchase for community groups, small businesses and other organisations. In 2022, the Irish Government announced VAT rates on defibrillators would be removed from January 2023, a measure designed to save lives and reduce pressure on healthcare services.

Scrapping the Heart Restart Tax in the UK will be an important step to see similar results and boost numbers of available defibrillators for use in public spaces and workplaces.

Commenting Torbay MP Kevin Foster said: “Defibrillators are a vital piece of life saving equipment and it has been great to see more and more places across our bay hosting them. By helping every small business, community group, and sports club to afford one, we will be one step closer to ensuring every person suffering from cardiac arrest can be moments away from crucial life-saving treatment."

##ENDS##